Is Tokyo Lifestyle (NASDAQ:TKLF) Facing Challenges in Capital Allocation? | PRIMENEWSNOW

Identifying the next big investment opportunity often involves spotting certain key trends. One such trend is a rising return on capital employed (ROCE) coupled with an increasing amount of capital being utilized. Essentially, these businesses are like growth engines, consistently reinvesting their profits at progressively higher returns. However, after examining Tokyo Lifestyle (NASDAQ:TKLF), it appears that its current trajectory doesn’t align with that of a multi-bagger.

Explore how 15 US stocks are set to benefit from recent developments in the oil and gas sector.

Decoding Return On Capital Employed (ROCE)

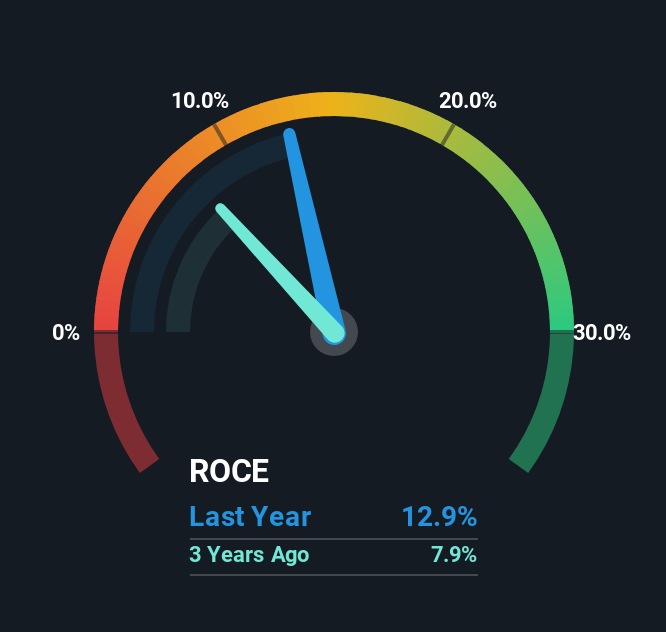

For those unfamiliar with ROCE, it evaluates the ‘return’ (pre-tax profit) a company generates from the capital it employs. For Tokyo Lifestyle, the calculation is as follows:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.13 = US$7.2m ÷ (US$197m – US$141m) (Based on the trailing twelve months to September 2025).

Thus, Tokyo Lifestyle’s ROCE stands at 13%, which aligns with the industry average.

Check out our latest analysis for Tokyo Lifestyle

While past performance isn’t always indicative of future results, understanding historical data can be insightful. For a deeper dive into Tokyo Lifestyle’s past performance, view this free graph of Tokyo Lifestyle’s past earnings, revenue, and cash flow.

Analyzing the ROCE Trend

Upon reviewing Tokyo Lifestyle’s ROCE trend, confidence wanes. Over the past five years, returns have dwindled from 36% to 13%. Despite this, both capital employed and revenue have grown, suggesting the company is prioritizing expansion, albeit at the expense of short-term returns. If this increased capital eventually yields higher returns, both the company and its shareholders stand to gain in the long run.

It’s worth noting that Tokyo Lifestyle’s current liabilities are quite high, constituting 72% of total assets. This indicates that a significant portion of the business is funded by suppliers or short-term creditors, which can introduce certain risks. While not inherently negative, a lower ratio could be more advantageous.

Final Thoughts

In conclusion, although short-term returns have dipped, Tokyo Lifestyle’s reinvestment strategy and increased sales are promising. However, the stock has plummeted 77% over the past three years, hinting at other challenges. Nonetheless, reinvestment could yield long-term benefits, making it a potential consideration for savvy investors.

Tokyo Lifestyle does present some risks. Our analysis uncovered 4 warning signs, one of which is particularly concerning.

While Tokyo Lifestyle’s returns aren’t the highest, explore this free list of companies with strong balance sheets and high returns on equity.

Valuation Made Simple

Discover whether Tokyo Lifestyle is undervalued or overvalued with our comprehensive analysis, which includes fair value estimates, potential risks, dividends, insider trades, and financial condition.

Have feedback on this article? Concerns about the content? Contact us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0