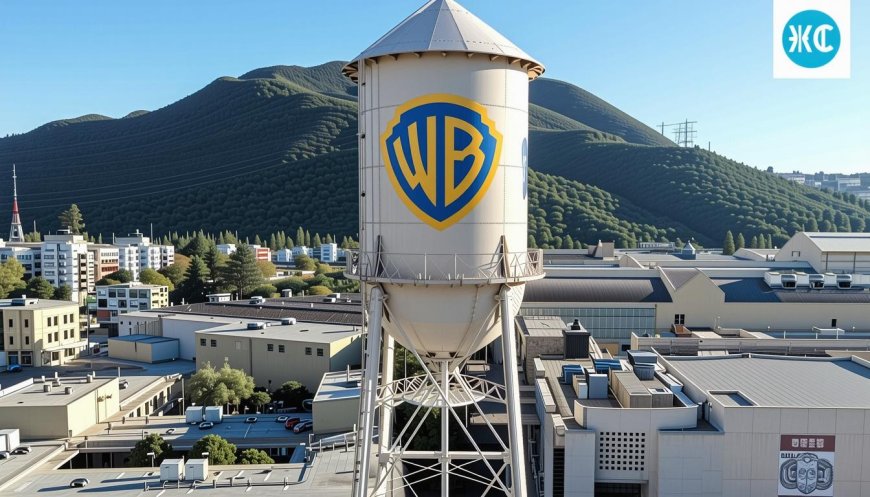

Paramount Launches Bold $108.4 Billion Bid for Warner Bros Discovery | PRIMENEWSNOW

Published on: Dec 08, 2025 07:49 pm IST

Paramount’s Ambitious Bid Faces Regulatory Challenges

On Monday, Paramount Skydance made headlines with a bold $108.4 billion offer for Warner Bros Discovery, aiming to disrupt Netflix’s plans and establish a formidable media entity.

Just last Friday, Netflix had emerged victorious in a fierce bidding war, securing a $72 billion equity deal for Warner Bros Discovery’s assets, including TV and film studios.

Paramount’s offer, valued at $82.7 billion with debt and a $5.8 billion break-up fee from Netflix, is expected to undergo intense antitrust examination.

Since September, Paramount has made several attempts to create a media giant capable of rivaling Netflix and tech behemoths like Apple, but faced repeated rejections.

Their proposal to acquire the entire company at $30 per share surpasses Netflix’s nearly $28 per share offer for specific assets.

Paramount’s Strategic Position in Hollywood

Despite being a major Hollywood studio, Paramount’s box office performance has been inconsistent, with occasional hits overshadowed by competitors like Disney and Universal.

In a letter to Warner Bros, Paramount questioned the fairness of the sale process, suggesting Netflix was unfairly favored.

Reports indicated Warner Bros’ management viewed the Netflix deal as a “sure thing,” while dismissing Paramount’s bid.

Industry Reactions and Political Implications

Experts believe Paramount is well-positioned to acquire Warner Bros Discovery, backed by Larry Ellison’s financial strength and political connections.

President Donald Trump expressed concerns about the Netflix-Warner Bros merger, suggesting it could impact market competition.

Bloomberg reported a meeting between Trump and Netflix co-CEO Ted Sarandos, where Trump advocated for selling to the highest bidder.

Netflix’s proposal has faced criticism from lawmakers and Hollywood unions, fearing job losses and increased consumer costs.

Future Prospects and Market Dynamics

Analysts predict the combined entity would face challenges unless Netflix significantly raises prices or operates separate platforms, which seems unlikely.

Sarandos assured that the deal would benefit consumers, shareholders, and talent, expressing confidence in the regulatory process.

Netflix aims to secure exclusive control over premium content, reducing reliance on external studios as it expands into gaming and live entertainment.

Access to Warner Bros Discovery’s extensive intellectual property would enhance Netflix’s credibility and reach in the gaming sector.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0